Your home is a result of your hard work and a safe haven for rest. Purchasing a home insurance will protect it from unexpected events such as home theft, robbery, accident, flooding or fire. The premium is usually calculated based on the home’s net floor area and coverage needed.

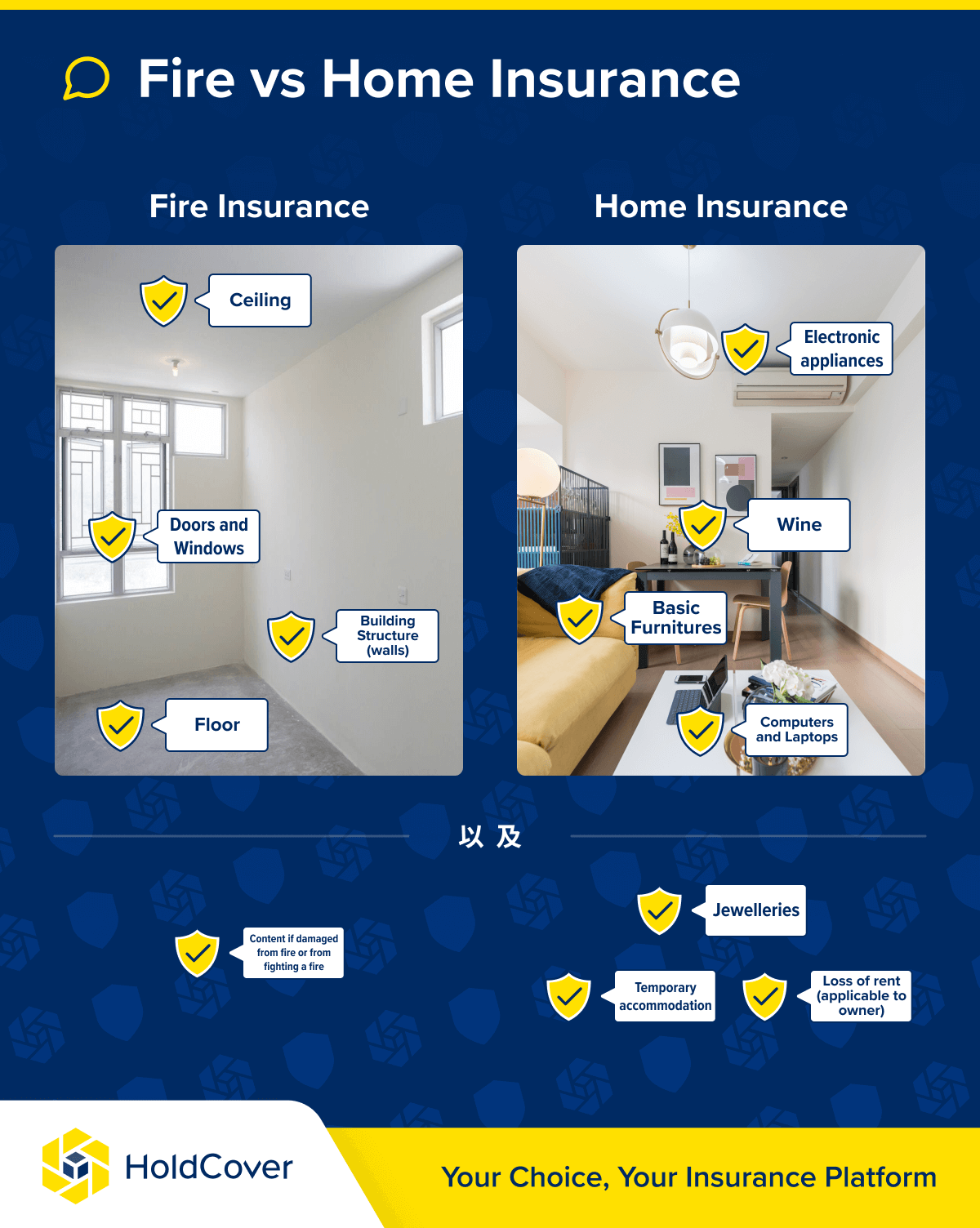

Fire Insurance

Fire insurance covers the building structure and fixture in case of an accident or natural disaster. Note that when applying for a mortgage from a bank, the bank generally requires the owner to have a fire insurance for the property.

Common fire insurance coverages include:

- Floor

- Ceiling

- Doors and windows

- Existing interior decoration

- Building structure (walls and tiles)

Fire insurance provided by insurance companies is basically identical to the ones provided by banks. In order to be a savvy consumer, request a quotation from HoldCover before applying for a mortgage.

Please note that the sum insured needs to be the same or more than the market value of the property.

Home Insurance

Your home is a result of your hard work and a safe haven for rest. Purchasing a home insurance will protect it from unexpected events such as home theft, robbery, accident, flooding or fire. The premium is usually calculated based on the home’s net floor area and coverage needed.

Common home insurance coverages include:

- Basic furniture

- Loss of rent (homeowners)

- Temporary housing allowance

- Home Appliances

- Mobile phone

- Computer

- Jewellery

- Wine

Other areas that may be insured include:

- Household contents accidentally damaged in mini-storage

- Domestic helper’s personal belongings accidentally damaged

- Damages incurred to household content while moving home

- Food spoil cause by unexpected power outage

- Physical or property damage to others anywhere in Hong Kong that is caused by domestic pets (limited to dogs and cats)

- Feng Shui consultation fee after an accident at home

If a home insurance includes personal liability, then property damages or bodily injury caused by the householder’s negligence will be liable for compensation.

Your Choice, Your Insurance Platform

Instant Quote, Compare and Buy insurance online.